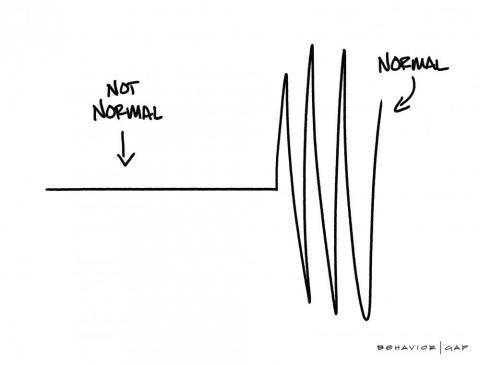

We’ve been told over and over by the traditional financial services industry to look for the best investment. In our search for the best, we often use past performance. Doing so makes sense since we rely on past performance for other decisions.

For instance, if a university needs a new basketball coach they start by reviewing a coach’s track record. Do they win more than they loses?

However, in a crazy paradox, selecting an investment manager using past performance may not be the best choice. But how is this possible? Hiring someone who performed terribly makes little sense.

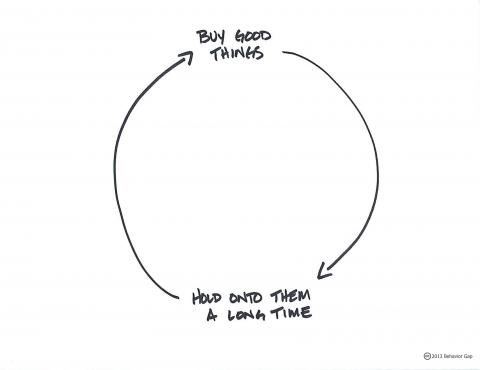

Even using a disciplined process and the best data we can find, "smart" activity often creates a behavior gap. The reality is that even if you own a mediocre investment, but if you behave correctly (sometimes that means doing nothing), you’ll outperform 99% of your neighbors.

In the end, successful investing is more like planting an oak tree than hiring a basketball coach.

You never plant a tree and then pull it out every time the wind blows just to check the roots. This simple, but not easy, approach reminds me of Warren Buffett who said:

"Benign neglect, bordering on sloth, remains the hallmark of our investment process."

Based on many conversations I’ve had, this attitude feels wrong. It seems like a contradiction to the Protestant work ethic. If something isn’t painful or hard, it’s not worth doing.

But when it comes to investing, we’re dealing with a different animal.

Once we’ve made a decision based on our personal goals and plans, often the best thing we can do is practice benign neglect. Simply do nothing, even though it feels wrong.

Try it. I think you’ll find that trees grow much better when you stop looking at the roots all the time.