Julie's Blog Posts

‘Tis the season! May your holidays sparkle with moments of love and laughter, and may the year ahead be joyful and prosperous. Merry Christmas!

Thank you to all our valued Clients for your support and business this year - we look forward to working with you in 2023!

Our office will close at 5pm on Tuesday, 20th December 2022 and reopen on Tuesday 3rd January 2023.

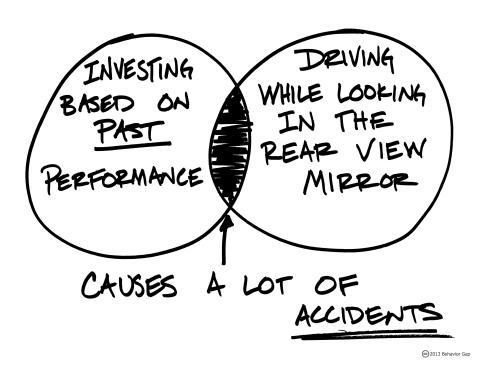

It is definitely no fun watching your hard earned money dropping in value when we are in the middle of economic turmoil, like we are right now! There is no magic balm to take that pain away and the real secret is to stop watching the markets daily when you know that your overall strategy is well thought out - you really do just have to hang in and stay the course!

I love reading economic articles where Commentators make predictions and comment on where the marketse are & what they might do next... but understand that is all they are - just an opinion and they do not always get it right! I read a recent article in the Financial Review that summarised this observation better than myself.... take a read here.

You cannot control the markets - you cannot accurately time the markets - the only thing you can control is your reaction to it all. Stay calm and stay seated. And if you are a client of mine and still need a chat about it all... pick up the phone.

There are a lot of people running around out there making a lot of noise and waving their hands, trying to tell you what you should be focusing on as an investor.

These “hand-wavey'' people talk about China, things like the Reserve Bank, monetary policy, stimulus, asset allocation, cryptocurrency, and shiny objects like silver and gold. It’s an awful lot to keep track of.

And don’t get me wrong, some of those things actually do matter. It’s not a bad idea to learn about them.

But one thing is certain: When it comes to investing, nothing matters anywhere near as much as your behavior.

You can design the greatest portfolio ever created by humankind, and one behavioral mistake a decade could mean you would've been better off in a bank account or stuffing the cash in your mattress.

So yes, the economy matters, smart portfolio design matters, how much we have in small cap, value, and growth, all those things matter.

But the thing that matters most is having investments that will allow you to behave.

In fact, I would argue that even portfolio design only matters to the degree that it influences good behavior.

Arguing over whether you should have 17.2% or 17.5% in emerging markets might be an interesting debate, but the difference between 17.2 and 17.5 is a misdemeanor when the felony we’re all committing is behaving poorly.

So next time a “hand-wavey” person shows up in your face telling you all the things you should be doing, just smile, nod, and walk away.

And remember that none of it matters if you don't know how to behave.

Blog written by Carl Richards from Behaviorgap.com :-)

A big change to the political landscape has occured with the change of government. So where to from here for us investors? What changes may occur that will impact on you? I read a great overview from Shane Oliver at AMP Capital recently... click on the below link to take a peek.

When it comes to your inception date with an investment advisor, chance plays a huge role.

The same goes for investment strategies going in or out of favour. Warren Buffett, the greatest investor of all time, has had multiple, prolonged periods of underperformance. His style was out of favour, but he stuck to it. And once again, he is reaping the rewards of his discipline. Berkshire Hathaway stock is up 18% year to date while the market is down 5%. So too does any investment style go in or out of favour. Ours is no exception.

Keep reading here for a great article about start dates: https://www.firstlinks.com.au/investment-performance-start-date-randomness